Who Gives Carbon Credits?

Gives Carbon Credits

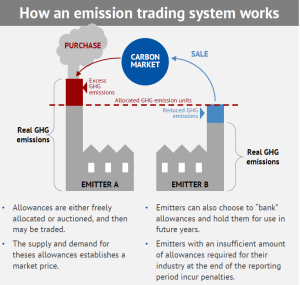

Carbon credits allow companies that emit too much CO2 to offset their emissions with activities that reduce, remove or store GHGs. They can be bought and sold to account for unavoidable pollution, help with corporate net-zero goals or to comply with legal frameworks like climate laws or environmental regulations. There are many ways to create carbon credits, including reforestation, wind turbines and biogas plants as well as energy efficiency measures and geological sequestration.

But the voluntary carbon.credit market is rife with quality concerns, particularly when it comes to verification. Buyers often struggle to find credits that meet their requirements for quality assurance and co-benefits such as community economic development or biodiversity protection, and suppliers face long lead times when they seek to verify new projects. The result is that high-quality credits are scarce, limiting the growth of the market.

A carbon credit is a tradable certificate that identifies one tonne of CO2 or greenhouse gas (e.g. methane, nitrous oxide and hydrofluorocarbons) prevented from entering the atmosphere. It is issued through a carbon credit scheme that has been certified by a third party and can be traded on the over-the-counter voluntary carbon market. The term is also used to describe carbon reduction or sequestration projects that are not part of a government programme such as the Clean Development Mechanism, and which can’t be used to achieve Kyoto Protocol emission cuts.

Who Gives Carbon Credits?

The price of a carbon credit varies, depending on the type of project it represents and its impact on the climate. For example, a credit created through reforestation can be more expensive than those from renewable electricity generation. Other factors include the volume of credits being traded at a particular time (the more volume, the lower the price), its geography and vintage, and whether it helps to meet specific Sustainable Development Goals of the United Nations.

To guarantee a carbon credit’s integrity, its underlying project must be validated and verified by a trusted body such as a standards organization. For example, the nonprofit Verra, established in 2007, offers a range of auditing and registration services to improve quality assurance in carbon markets. Its most widely accepted verification standard, called the Verified Carbon Standard, includes accounting methodologies specific to a project type, independent verification and a registry system.

Another key issue is the permanence of a carbon credit. For example, reforestation projects need to be permanent, otherwise the carbon will simply be released back into the atmosphere when the land is eventually cleared for agriculture or timber production. For this reason, some companies only buy from reforestation or other permanent projects that have a good chance of staying in the field for 100 years or more.

To speed up the process of creating, selling and trading carbon credits, some exchanges have set up standardized products that ensure certain specifications are respected. For instance, the Xpansiv CBL and ACX global nature products are guaranteed to have a certain type of underlying project, a certain level of permanence and a standard certification from a limited group of standards organizations. However, a large number of bilateral deals that are negotiated offscreen continue to make up a significant proportion of the trades on CBL.