How to Conduct Due Diligence for a Small Business

Conduct Due Diligence for a Small Business

For most business owners, due diligence is often a daunting task. It is the time-consuming part of a deal, and it requires scouring all available records and checking multiple sources. But, it’s an essential process that can help protect you from getting burned on a bad business acquisition or partner relationship. It’s especially important for small businesses that are looking to buy a larger company, merge with one or enter into a partnership or virtual partnership.

How to do Due Diligence on a Small Business

The reason that small businesses are particularly vulnerable to problems arising from the lack of adequate due diligence is that they typically have smaller profit margins than their larger counterparts, which means that a few missteps can cause financial disaster. In addition, many small business owners are less experienced at conducting due diligence and may overlook issues that could prove costly.

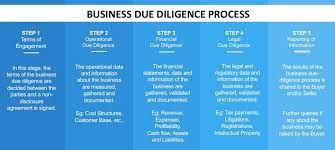

There are many different areas of research that are required in the due diligence process, depending on the type of small business being investigated. For example, if you are evaluating a small business that is owned by an entity such as a corporation or LLC, you will need to review the documents that created the entity and those that govern it. This can be a time-consuming process, but it is necessary to evaluate the potential tax implications of the purchase.

How to Conduct Due Diligence for a Small Business

You will also want to investigate the product or service that the business provides and the competitive landscape for this product or service. You will need to know how much it costs to create the product and what the profit margins are. In addition, you will need to determine if the company is using any proprietary technology that may be lost in the acquisition and what intellectual property (IP) protections — such as patents and trademarks — it has in place.

Conducting Due Diligence for a Small Business

Human resources due diligence: It is also important to understand the workforce and their relationships with management. You will need to examine employee contracts and compensation packages as well as any other HR policies. This can help you decide whether the company will be able to continue to function efficiently after the sale and what kind of integration or transition plan would be appropriate.

Steps to Perform Due Diligence on a Small Business

As a result, the due diligence process can be a very time-consuming and tedious undertaking, which is why it’s crucial to perform it thoroughly and with a professional team on your side. The more that you can anticipate what buyers will request, the easier it will be to prepare your company for a smooth and successful sale.